Reimagining Finance Through AI & Design

LifeLas empowers users to design their financial future with visual clarity and confidence.

LifeLas empowers users to design their financial future with visual clarity and confidence.

February 2025

"The app made me feel like I was finally in control of my money."

- Sarah M., Beta User

LifeLas is a revolutionary fintech application that transforms how people visualize and achieve their financial goals. By combining AI-powered insights with intuitive design, we've created a platform that makes financial planning feel less like a chore and more like designing your dream life. Our unique LifePath Engine creates dynamic roadmaps that adapt to users' changing circumstances, while GoalPods make saving feel tangible and achievable.

Understanding our users to create meaningful financial experiences

Primary Persona

"I want to see my financial future, not just track my spending. Show me how my decisions today impact my goals tomorrow."

Secondary Persona

"I'm just starting my financial journey and need guidance. I want to make smart decisions but don't know where to begin."

Users need to see their financial future to stay motivated. Abstract numbers don't inspire action.

Users want to learn while they plan. Financial literacy builds confidence and better decisions.

Gamification and progress tracking keep users engaged with their long-term financial goals.

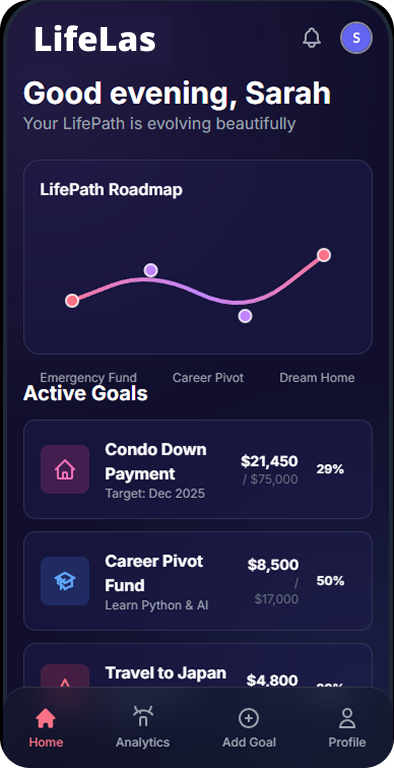

Dynamic roadmap with interactive nodes that adapt to your financial journey in real-time.

Visual progress tracking

Gamified savings containers for specific goals like Travel Fund or Condo Downpayment.

🏠 Condo Downpayment

$21,450 / $60,000

✈️ Travel Fund

$4,800 / $8,000

Anonymous journeys and circles where users share progress and motivation.

Real-time budgeting tips and personalized financial insights powered by machine learning.

💡 "You're $240 ahead this month! Consider boosting your Travel Fund."

Visualize career progression and income potential to align with your financial goals.

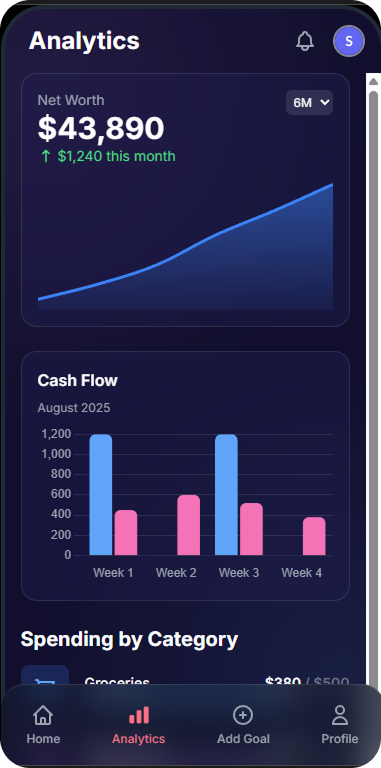

Comprehensive spending analysis with beautiful visualizations and actionable insights.

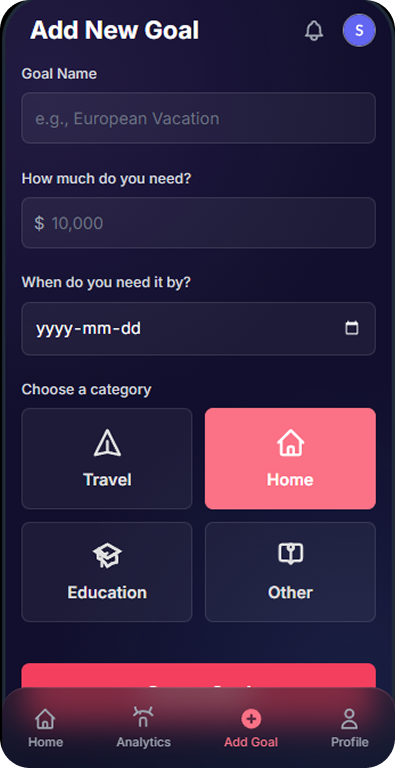

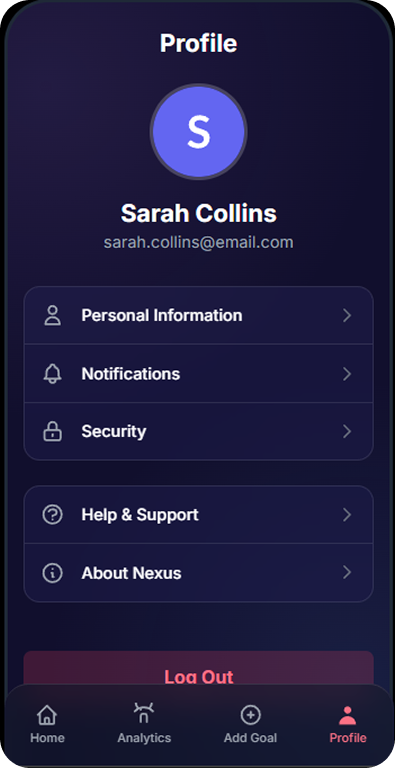

Explore the complete LifeLas experience through our intuitive interface design that makes financial planning feel effortless and engaging.

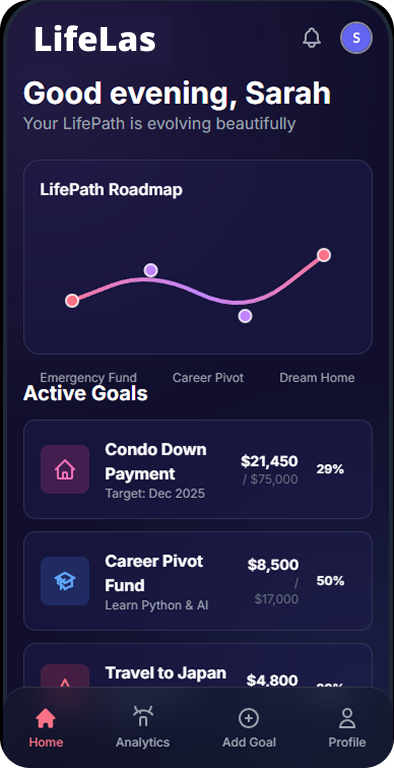

LifePath roadmap with active GoalPods showing real progress toward financial milestones.

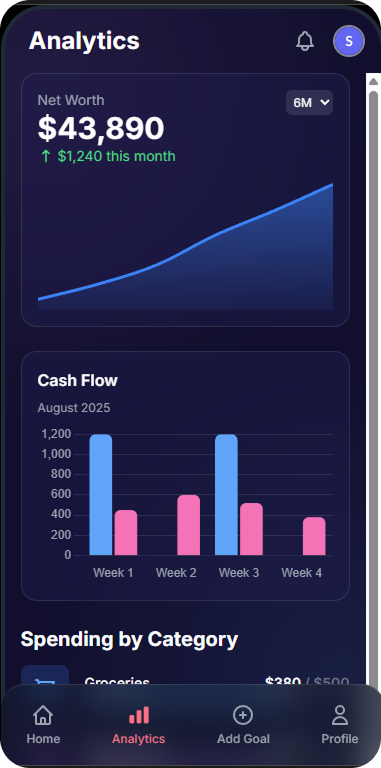

Comprehensive financial insights with net worth tracking and spending analysis.

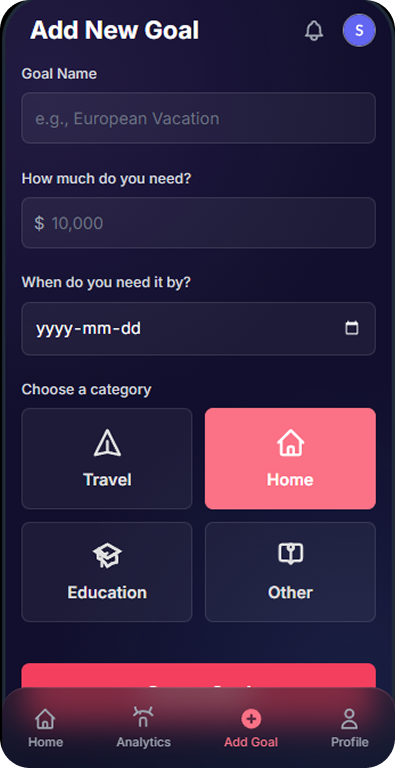

Intuitive goal setup with category selection and timeline planning.

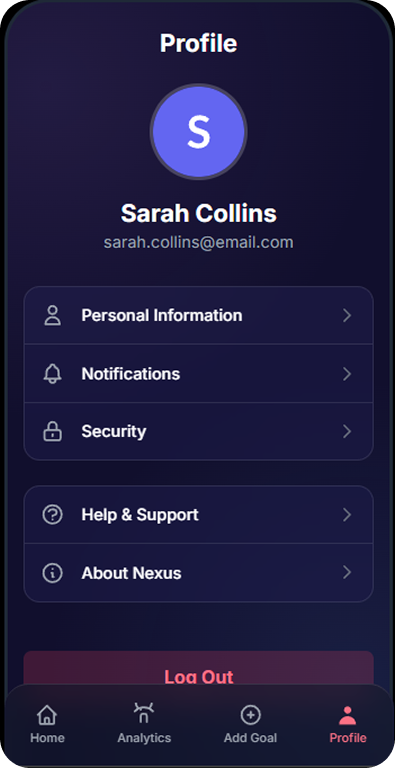

Clean settings interface with security and personalization options.

The LifePath roadmap transforms abstract financial goals into a tangible journey with clear milestones.

GoalPods make saving feel like a game, with progress bars and achievement unlocks that motivate users.

Beautiful data visualization helps users understand their financial patterns and make informed decisions.

Struggle to visualize long-term financial goals

Desire personalized financial advice without judgment

Learn better through visual and interactive interfaces

"I never understood where my money was going until LifeLas showed me those beautiful charts. Now I actually look forward to checking my finances."

Alex Chen

Software Engineer, 28

"The GoalPods feature made saving for my wedding feel like a game. We hit our target 3 months early!"

Maria Rodriguez

Teacher, 31

"Our research revealed that traditional banking apps create anxiety rather than confidence. LifeLas was designed from the ground up to be empowering, not overwhelming."

Dr. Jennifer Kim

Lead UX Researcher

Designing a Richer Financial Future

To create a mobile-first app that empowers users to manage, visualize, and align their financial decisions with long-term personal and career goals using AI and data storytelling.

Many users struggle to connect their day-to-day financial choices with meaningful long-term goals. Traditional finance apps focus on budgeting and analytics, but often lack motivational guidance, personalized roadmaps, or career-growth integration.

Participants: 35 Gen Z and Millennial professionals in urban Canadian cities

An onboarding system that analyzes user goals, career data (via LinkedIn), and financial health to create a dynamic roadmap—a constellation-like map with interconnected milestones and timelines.

Investing reimagined: Users contribute to themed pods like "Move to Vancouver" or "Retire by 45" with AI-managed portfolios tailored to the goal's timeline and risk tolerance.

Smart AI suggestions on budgeting, savings, or career growth delivered daily in snackable cards. Users can save, share, or take action directly.

Users can explore anonymized Journeys and form "Circles" for shared goals like "Group Euro Trip 2026."

The system recommends regional certifications and career transitions—e.g., "French Public Sector Bonus" or "Switch to Tech via Google Cert." All are tied to financial outcomes.

Expand web version for desktop financial planning

Introduce multilingual onboarding experience

Partner with local learning platforms for embedded courses

LifeLas stands at the intersection of financial empowerment and life design. By weaving together personal ambitions, real-time data, and beautiful design, it redefines how the next generation navigates money and meaning.

Four core screens showcasing the complete user journey from goal creation to progress tracking.

Multiple app icon variations exploring different visual approaches and brand identity concepts with consistent color palette.

Large-scale marketing campaign showcasing the brand's visual identity and core value proposition.

Financial Freedom

Starts Here

Your Goals

Visualized

AI-Powered

Insights

FinanceInfluencer

@financeinfluencer • Sponsored

Just tried @LifeLasApp and I'm blown away! 🤯 The visual approach to financial planning is exactly what my followers have been asking for. The GoalPods feature alone is worth the download! #FinTech #PersonalFinance #LifeLas

LifeLas App

Design Your Rich Life

Join thousands of users who have transformed their financial future through visual planning and AI-powered insights.

Download on the

App Store

Get it on

Google Play